Table of Contents

ToggleWhat Is Leasehold Commercial Property?

A leasehold commercial property is a building or space that you don’t own—you simply rent it for a long period of time. Instead of buying the property outright, you sign a legal agreement that allows you to use the space for your business. This agreement usually lasts several years, and during that time, you can run your shop, office, warehouse, or any other type of business inside it.

It works just like renting a home, but the terms are more detailed because it’s for business use. You agree to pay rent, follow certain rules, and take care of the parts of the property that the lease mentions. The landlord still owns the building, but you get full daily control of the space for the length of your lease.

Let’s explore the whole guide with an in depth breakdown. Before I begin into it I am Damiano Cerrone your go to expert to guide you in detail. I have over 10 years of experience in urban planning, architecture, and digital innovation.

So let’s begin.

What Does Leasehold Mean in Commercial Real Estate?

In commercial real estate, “leasehold” simply means you have the right to use the property, not the right to own it. You get access to the space, you can run your business inside it, and you can make improvements if the lease allows. But when the lease ends, the space goes back to the landlord unless you renew your agreement.

Think of it as borrowing a place for your business for a set number of years. You get stability without paying the big costs of buying a building, which makes leasing a common choice for small and growing businesses.

How a Commercial Lease Agreement Works

A commercial lease agreement is a contract that explains the rules for using a business property. It lays out what the landlord expects from you and what you can expect from them. This agreement usually includes how long you can stay, how much you will pay, and what responsibilities both sides have.

Most commercial leases run for several years, which gives your business stability. During that time, you agree to take care of the space, pay rent on time, and follow the terms written in the contract. In return, the landlord provides a safe and usable property where you can operate your business without interruptions.

The agreement is meant to protect both sides. It makes everything clear from day one so you know exactly what you’re responsible for and what the landlord must handle.

Key Terms You’ll Find in a Lease

A lease often includes a lease covenant, which is basically a promise you make to follow certain rules—like using the space only for approved activities or keeping it in good condition.

Another important part is the lease term and renewal, which tells you how long you can stay and whether you can extend your lease when the current term ends. This helps you plan ahead and avoid unexpected surprises.

You may also see something called a schedule of conditions. This is a document, often with photos, that shows what the property looks like at the start. It protects you by proving you didn’t cause any damage that was already there before you moved in.

Common Costs You Need to Plan For

Running a business space comes with a few predictable costs. The main one is market rent, which is the amount you pay for using the property based on local prices.

You’ll also need to budget for business rates, which are taxes charged on commercial buildings. These vary depending on the location and size of the property.

Another ongoing cost is service charges, which cover shared expenses like cleaning common areas, maintaining the building, or repairing shared systems. These charges help keep the whole property in good condition for everyone.

Read More: Pedrovazpaulo Real Estate Investment Explained Simply – Axurbain Media Guide

Freehold vs Leasehold: What’s the Real Difference?

Freehold vs Leasehold

When people talk about freehold vs leasehold, they’re simply comparing two different ways of using or owning a property. The difference is actually easy to understand.

A freehold means the person owns the building and the land under it. They have full control and don’t have to ask anyone for permission to make changes. A leasehold, on the other hand, means you are renting the space for a set number of years, and the landlord still owns the property.

For business owners, the choice usually depends on budget and how long they plan to stay. Leasehold is more common because it costs less upfront and gives you a place to operate without buying the entire building.

Here’s a quick and simple comparison:

- Leasehold: You rent the property for a set time and follow the lease rules.

- Freehold: You own the building and have full control.

- Leasehold: Lower upfront cost, easier for new businesses.

- Freehold: Higher cost but long-term ownership.

In short, freehold is full ownership, while leasehold gives you long-term use without buying the property.

Important Legal Points for Tenants By Damiano

In the last 10 years, I’ve seen many problems, and these legal points can help you avoid trouble.

When you’re taking a commercial space, understanding a few key legal points can save you from problems later. These legal details help you know your rights, your limits, and what you can or can’t do inside the property.

One of the most important laws is the Landlord and Tenant Act 1954, which protects many business tenants by giving them the right to stay or renew their lease when the term ends. Not every lease includes this protection, so it’s important to check if yours does.

Before a full contract is written, both sides often agree on early details called Heads of Terms. This short document sets the basic deal like how long the lease will last, how much you’ll pay, and what you’re responsible for. It’s not the final contract, but it helps make the process smoother.

Most leases also include a break clause. This gives you the option to end the lease early if your business needs change. It’s useful for reducing risk, especially if you’re unsure how long you’ll stay.

Another key point is assignment and subletting, which explains whether you can pass the lease to another business or rent part of the space to someone else. Some landlords allow this, while others don’t, so it’s important to know your options.

Because these terms can feel confusing, many tenants work with a commercial property solicitor. This professional checks the lease, explains the rules in simple language, and makes sure you’re protected before you sign anything.

These legal points might seem small, but they can make a big difference in how safe and confident you feel in your new business space.

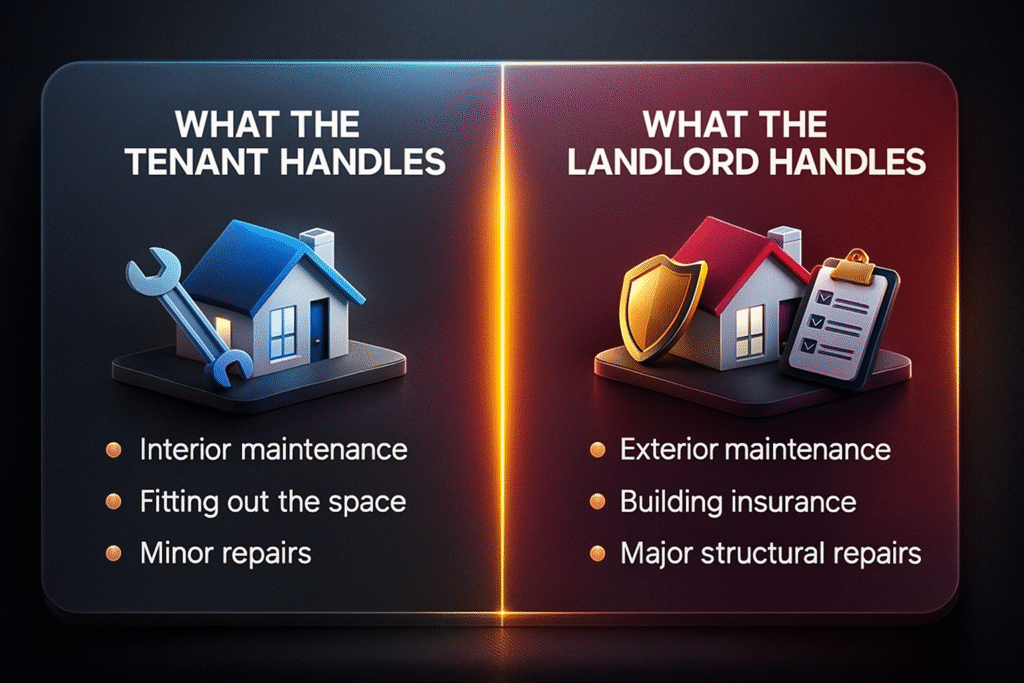

Repair and Cost Responsibilities in a Leasehold Property

When you rent a business space, it’s important to know who handles repairs and what costs you’re expected to cover. Every lease is different, so understanding these responsibilities from the start can save you money and stress later.

Some properties use a Full Repairing and Insuring (FRI) lease, which means you take care of most repairs and the general upkeep of the space. You also cover the cost of insuring the property. This type of lease gives you more control, but it also means you need to plan for unexpected maintenance costs.

At the end of your lease, the landlord may check the condition of the property. If the space is damaged or worn out beyond what’s considered normal use, you might be asked to pay for dilapidations. These are repair costs needed to bring the property back to its original condition. A clear record at the start of the lease helps protect you from unfair charges.

You may also have tenant fit-out obligations, which cover the improvements you make when setting up your shop, office, or workspace. These obligations explain what changes you can make, who pays for them, and whether you need to remove anything when your lease ends.

Overall, knowing your repair duties and costs helps you avoid surprises and keeps your business running smoothly.

Read More: Invest1now.com Real Estate: Best Investment Opportunities

Financial and Long-Term Considerations for Businesses

When you take a commercial space, it’s not just the rent you need to think about. There are short-term costs you pay at the beginning and long-term costs that continue throughout the lease. Understanding both helps you plan your budget and avoid surprises later.

One of the first expenses you might come across is Stamp Duty Land Tax (SDLT). This tax applies when your lease reaches a certain value, and many tenants don’t expect it. It’s a one-time payment, but it can affect your starting budget, so it’s good to check early.

To make things easier, here’s a simple table comparing the upfront costs you face at the beginning and the ongoing costs you’ll manage while you’re running your business.

Upfront Costs vs Ongoing Costs

| Upfront Costs | Ongoing Costs |

| Deposit | Monthly or yearly rent |

| Stamp Duty Land Tax (SDLT) | Service charges |

| Legal fees | Utility bills |

| First rent payment | Business rates |

| Initial fit-out costs | Maintenance and repairs |

Pros, Cons, and Risks of Leasehold Commercial Property

Leasehold property can be a smart choice for many businesses, but it’s important to understand both the good and the bad before you commit. Here’s a simple breakdown to help you make a clear decision without confusion.

Pros (The Good Side)

One of the biggest pros and cons of leasehold is cost. The good part is that leasing usually has a much lower upfront cost compared to buying. This makes it easier for new or growing businesses to get a property without a huge financial hit.

Another benefit is cost predictability. You normally know your rent and other main costs, which helps you plan your budget and avoid big surprises.

Many tenants also enjoy that they don’t have to worry about major building issues. Since the landlord owns the property, some big repairs may not be your responsibility (depending on your lease). This can reduce stress and save time.

Cons (The Not-So-Great Side)

The downside is that leasehold comes with ownership limitations. You can use the property, but you don’t own it. That means you must follow the landlord’s rules, and you can’t always make changes to the space without permission.

Another drawback is freedom vs restrictions. Some leases limit how you can run your business, what changes you can make, or even what hours you can operate. This can feel restrictive if you want full control.

There are also long-term cost implications. Even if leasing feels cheaper at first, the total cost over many years can add up. Renewals, rent increases, and repairs can slowly push expenses higher than expected.

Risks You Should Know About

Every lease comes with the risks of leasehold property. One risk is that your landlord might decide not to renew your lease, forcing you to move. This can disrupt your business, especially if you run a shop or rely on foot traffic.

Another risk is unexpected repair bills. Even if you take care of your space, you might still face end-of-lease repair costs or other responsibilities depending on your agreement.

Making the Lease vs Buy Decision

The lease vs buy decision depends on your long-term plans. Leasing is great for flexibility, smaller budgets, and new businesses. Buying is better if you want full control and long-term ownership.

Understanding Exit Options

Before signing, make sure you understand the exit options for tenants. Some leases let you leave early under certain conditions, while others make it harder. Knowing this in advance helps you avoid being stuck in a place that no longer fits your needs.

What to Check Before Signing a Lease

This coral guide will also help yo a lot to understand your core intent.

Before you agree to any business property, there are a few key things to check before signing a lease. These checks help you stay protected, avoid hidden costs, and make sure the space truly fits your business needs.

Here’s a simple checklist to guide you:

Quick Checklist for Tenants

- Check the length of the lease and make sure it matches your business plans.

- Read the repair responsibilities so you know what you must fix and what the landlord handles.

- Confirm the total costs, including rent, service charges, and taxes.

- Look at the condition of the property and note any damage before moving in.

- Ask about renewal options so you understand what happens when the lease ends.

- Review any restrictions, such as hours of use or rules about changes to the space.

- Check break clause details, if the lease includes one, so you know how to leave early if needed.

- Understand who pays for fit-out work, and what must be removed later.

- Make sure the space is legally approved for the type of business you want to run.

- Ask questions until everything is clear—never sign a lease you don’t fully understand.

Taking a few extra minutes to check these points can save you from unexpected problems and help you feel confident before committing to a new commercial space.

FAQs

Is It Worth Buying a Leasehold Business?

Yes, it can be. It costs less than buying the building, and you can start operating quickly. Just make sure the lease terms and remaining years fit your long-term plans.

What Does It Mean to Lease a Commercial Property?

It means you rent a space for your business instead of owning it. You pay rent, follow the lease rules, and use the property for the length of your agreement.

Conclusion

Choosing a commercial space is a big step, and understanding how leasehold works makes the process much easier. Leasing gives you the room your business needs without the high cost of buying a building. But it also comes with responsibilities, rules, and decisions you should think through carefully.

By knowing the key terms, legal points, costs, and risks, you can make a smart choice that supports your business for years. Always read your lease closely, ask questions, and plan ahead. With the right information, you can pick a space that fits your goals and helps your business grow with confidence.